Short Term Bridging Loans:

Fast Access to Financial Flexibility

The Quick Fix in Finance

Ever found yourself in a financial pickle, needing a quick infusion of cash to bridge a gap?

Enter the world of short term bridging loans, the financial world’s equivalent of a quick fix – fast, effective, and occasionally spiced with a hint of adrenaline.

Whether you’re eyeing a property at auction, awaiting a traditional mortgage, or embarking on a property development project, bridging loans are there to… well, bridge that financial gap.

Let’s dive into what makes bridging loans the Swiss Army knife of finance.

Understanding Bridging Loans

Understanding bridging loans offers a gateway to swift and versatile financial solutions for both individuals and businesses alike.

Bridging finance, essentially a short-term funding option, fills the gap between an immediate financial need and the securing of longer-term financing.

Whether it’s facilitating the purchase of a new property before the sale of an existing one, providing capital for property development, or even supporting a business in a cash flow crunch, bridging loans serve as a rapid and flexible financial lifeline.

With options ranging from residential bridging loans for house purchases to commercial bridging finance for business investments, and from quick bridging loans for urgent needs to development bridging finance for project completions, the variety and adaptability of bridging loans make them an appealing choice.

Despite their higher cost compared to traditional loans, their speed, convenience, and bridging finance solutions tailored to specific scenarios—like auction purchases or property refurbishments—justify the expense for many.

Bridging loan companies and brokers can offer bespoke solutions, including regulated bridging loans for personal use and unregulated options for commercial ventures, ensuring a fit for nearly every financial circumstance.

Bridging Loan Basics

At its core, a bridging loan is a type of short-term financing, designed to provide a temporary cash flow solution.

It’s the financial equivalent of a plank you hastily throw over a stream to cross to the other side – it’s not meant for long-term use, but it gets you where you need to go, quickly.

Closed Bridging Loan: The Predictable Path

Imagine marking your calendar with a big red circle, indicating the exact date when you’ll repay your loan. That’s the essence of a Closed Bridging Loan.

It’s the financial equivalent of booking a non-refundable flight; you know precisely when it’s happening.

This type of loan is ideal when you have a clear exit strategy in place – perhaps you’re awaiting the sale of your current home to fund the purchase of a new one, or you have a guaranteed income arriving on a specific date.

The certainty of a fixed repayment date often translates to lower interest rates compared to its open counterpart, making it a cost-effective option for those who value predictability in their financial planning.

It’s a preferred choice for short term bridging finance when timing and cost efficiency are paramount.

Open Bridging Loan: The Flexible Route

On the flip side, if you’re someone who finds excitement in not knowing exactly where the road turns but trusts you’ll reach your destination eventually, the Open Bridging Loan mirrors this sentiment in the financial realm.

It doesn’t pin you down with a fixed repayment date, providing a blanket of flexibility for those unpredictable financial scenarios. Whether you’re in the process of selling a property but haven’t secured a buyer yet, or you’re awaiting approval on a long-term financing solution, this type of loan acknowledges the fluidity of your situation.

The open nature does typically come with slightly higher interest rates, reflecting the increased risk for the lender. However, it offers invaluable breathing space for bridging finance on property, property development, or even navigating through temporary liquidity shortages in business ventures.

Both Closed and Open Bridging Loans serve as vital tools in the financial toolkit, designed to match the tempo and certainty (or lack thereof) of your financial needs.

Whether you lean towards the structured assurance of a Closed Bridging Loan or the adaptable embrace of an Open Bridging Loan, understanding the nuances of each can guide you to make informed decisions that align with your short-term financial strategies and long-term goals.

The Perks of Picking Bridging Finance

Bridging finance, often referred to as a bridging loan or bridge loan, is a short-term financing option designed to bridge the gap between an immediate funding requirement and the arrangement of longer-term financing.

It serves various purposes, such as real estate transactions, business cash flow solutions, or any scenario where quick funding is essential. The primary perks of picking bridging finance, particularly its speed, are detailed below:

Speed Is of the Essence

Quick Approval and Access to Funds

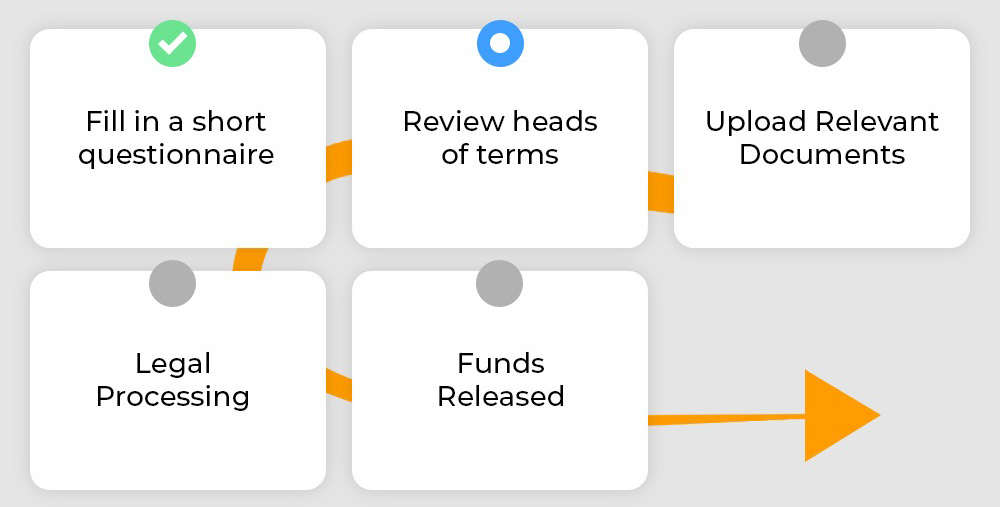

Bridging loans are known for their rapid approval process compared to traditional long-term financing options like mortgages or conventional business loans. Lenders specializing in bridging finance typically have streamlined evaluation processes, allowing them to assess and approve loan applications much faster. In some cases, approval can be obtained within 24 hours.

This speed is crucial in scenarios where capital is needed quickly, such as seizing a time-sensitive investment opportunity or closing a real estate deal before another buyer steps in.

Efficiency in Meeting Urgent Financial Needs

The fast-paced nature of bridging loans makes them an efficient tool for meeting urgent financial needs. Whether it’s preventing a property sale from falling through due to delayed financing or providing immediate cash flow to a business facing a temporary shortfall, bridging finance fills the gap effectively. Its efficiency lies not just in the speed of obtaining the loan but also in the ability to tailor the financing to the borrower’s specific timeline, ensuring that funds are available exactly when needed.

Key Benefits of Bridging Finance

Flexibility: Bridging loans offer flexible terms, including loan amounts, repayment plans, and interest payment options. This flexibility allows borrowers to structure the financing in a way that best suits their needs and repayment capacity.

Solution to Timing Issues: In many financial transactions, especially in real estate, timing discrepancies between the sale of one property and the purchase of another can create cash flow challenges. Bridging finance resolves these timing issues by providing the necessary funds to bridge this gap.

Enables Quick Decisions: The assurance of fast access to funds with bridging finance empowers borrowers to make quick decisions, take advantage of immediate opportunities, or resolve financial emergencies without delay.

Short-Term Commitment: As a short-term financing solution, bridging loans typically have a term of up to 12 months, allowing borrowers to resolve their immediate financial needs without committing to long-term debt obligations.

No Early Repayment Penalties: Many bridging loans do not have early repayment penalties, which means borrowers can repay the loan as soon as their longer-term financing is arranged or their cash flow situation improves, without incurring extra costs.

Bridging the Gap to Traditional Financing

For those caught in the limbo between needing immediate funds and waiting for a mortgage or long-term loan, bridging finance is the perfect intermediary.

The Flip Side: Costs and Considerations

The Price of Speed

Bridging loans offer quick, flexible financing but come at a higher cost than traditional loans due to elevated interest rates and additional fees, reflecting the increased risk and convenience.

These loans, ideal for urgent financial gaps, require careful consideration of their higher borrowing costs and a solid exit strategy to manage repayment.

It’s essential to weigh these factors against the immediate need for funds to ensure that the benefits justify the expense.

A Short-Term Solution

Bridging loans serve as a short-term financial solution, akin to a Band-Aid, providing temporary relief rather than a permanent cure. They’re designed to address immediate funding needs or to bridge a gap until a more sustainable financial arrangement can be made.

The essence of using a bridging loan wisely lies in having a well-defined exit strategy for repayment. This could be through the sale of a property, securing a long-term loan, or another reliable funding source anticipated in the near future.

Without a clear plan for repayment, borrowers risk financial strain, making it crucial to consider how the loan will be settled before taking it on.

Finding the Best Bridging Loan

Shop Around

When searching for the optimal bridging loan, it’s beneficial to explore a wide range of lenders, including traditional banks and specialist bridging finance firms.

Utilizing a bridging loan calculator can greatly aid in this process, offering a quick way to compare the financial implications of various loan options.

The landscape of bridging finance is diverse, with each lender offering varying interest rates, loan terms, and service levels. While securing a competitive interest rate is crucial, equally important are the lender’s approval times and the flexibility of the loan terms.

Fast approval can be critical for time-sensitive opportunities, and flexible terms can offer vital adaptability for repayment. By thoroughly comparing options, borrowers can identify a loan that not only meets their immediate financial needs but also aligns with their repayment strategy, ensuring a balance between cost, speed, and adaptability.

Consider the Total Cost

In evaluating bridging loan options, it’s essential to delve deeper than just the advertised interest rates.

Hidden costs, including arrangement fees and possibly others like legal or valuation fees, can significantly increase the overall expense of the loan.

These extra charges should be factored into your decision-making process to ensure a comprehensive understanding of the total cost involved.

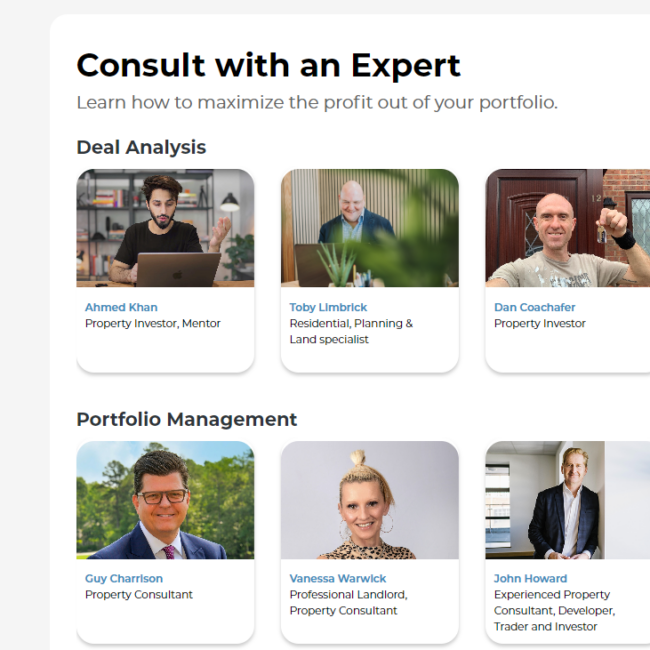

Expert Advice Is Priceless

Seeking expert guidance in the complex bridging loan market is invaluable. It’s comparable to navigating a dense financial jungle where the right direction isn’t always clear.

Bridging finance brokers, with their specialized knowledge and industry connections, can illuminate the best route for your needs, helping you to identify the most suitable options and avoid potential pitfalls.

Conclusion: Bridge Your Way to Financial Freedom

In the ever-complex financial landscape, short term bridging loans stand out as a versatile and speedy solution to immediate cash needs. Whether it’s securing that dream property, kickstarting a development project, or keeping your business afloat, bridging finance can be the bridge to your financial goals. Just remember, with great power comes great responsibility – ensure you have a solid repayment plan to avoid turning your financial bridge into a plank you’d rather not walk.

Sign Up for Free Today & Get 40% Off Lendlord Premium Plan!