What Mortgage Deal is Right for Me: Navigating Property Investment and Sourcing

Investing in the property market through strategic property sourcing can lead to lucrative returns, providing a stable income stream and long-term wealth accumulation. Before embarking on your property investment journey, it’s crucial to delve into the financial intricacies, particularly in selecting the mortgage deal that aligns with your investment goals and property sourcing strategy. The myriad of mortgage options available can make this decision seem overwhelming. Today, we aim to simplify this process by examining the various types of mortgage deals in the UK, guiding you through the complexities to identify the most suitable choice for your property sourcing endeavors.

Fixed-Rate Mortgage:

A cornerstone for many property investors, the fixed-rate mortgage offers the stability and predictability prized in the property sourcing world. This mortgage type locks in your interest rate for a predetermined period, typically from two to ten years, ensuring consistent monthly repayments. This predictability is invaluable for effective budgeting, especially when planning long-term property investments. Fixed-rate mortgages shield investors from fluctuating interest rates, providing a safeguard during low-rate periods. However, it’s worth noting that the initial interest rates might be slightly higher than those of variable-rate mortgages, an important consideration in your property investment strategy.

Variable Rate Mortgage:

Variable rate mortgages, also known as tracker mortgages, have interest rates that fluctuate with the Bank of England base rate or the lender’s standard variable rate (SVR). These mortgages often start with a lower initial interest rate compared to fixed-rate mortgages. While the rate can increase or decrease over time, it is essential to be prepared for potential fluctuations in your monthly repayments. Property investors who have the financial flexibility to accommodate potential rate changes may find variable-rate mortgages appealing.

Discounted Rate Mortgage:

Similar to tracker mortgages, discounted rate mortgages offer an interest rate that is below the lender’s standard variable rate for a specified period. The discount rate can vary, typically lasting for a few years. This type of mortgage deal can be an attractive option for property investors seeking lower initial repayments. However, it’s crucial to understand that as the lender’s variable rate changes, so will your repayments. Therefore, carefully assess your financial circumstances and determine if you can comfortably handle potential increases in monthly payments.

Buy-to-Let Mortgage:

If you’re specifically looking to invest in rental properties, a buy-to-let mortgage is tailored for this purpose. Buy-to-let mortgages have different criteria and rates compared to residential mortgages. Lenders will typically assess your projected rental income, and the loan amount may be based on this potential income. Interest rates for buy-to-let mortgages can be higher, and there might be additional fees and requirements. It is crucial to thoroughly research the rental market and consider factors such as rental yield and potential rental income before pursuing this option.

Interest-Only Mortgage:

Interest-only mortgages allow property investors to pay only the interest on the loan each month, without repaying the principal amount. This option can provide more flexibility in managing cash flow, as the monthly repayments are lower. However, it is important to note that the principal amount will need to be repaid at the end of the mortgage term. Interest-only mortgages are generally suitable for experienced investors with solid repayment plans, such as selling the property or using other investment returns to clear the loan.

Each type of mortgage has its own advantages and considerations. By understanding the differences between fixed-rate, variable rate, discounted rate, buy-to-let, and interest-only mortgages, you can make an informed decision that aligns with your investment strategy, financial goals, and risk appetite.

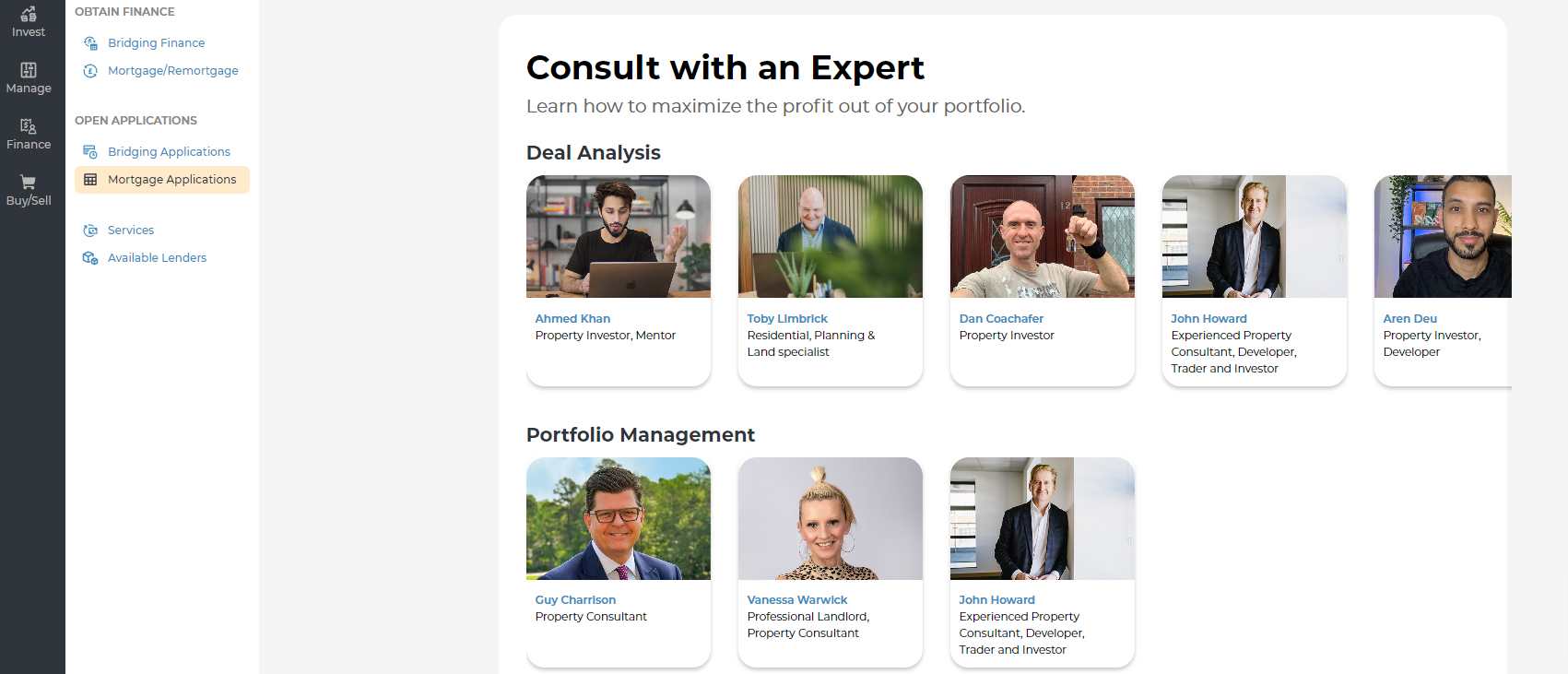

Before committing to a mortgage deal, it is highly recommended to seek advice from a professional mortgage advisor who can analyze your specific circumstances and guide you through the options available.

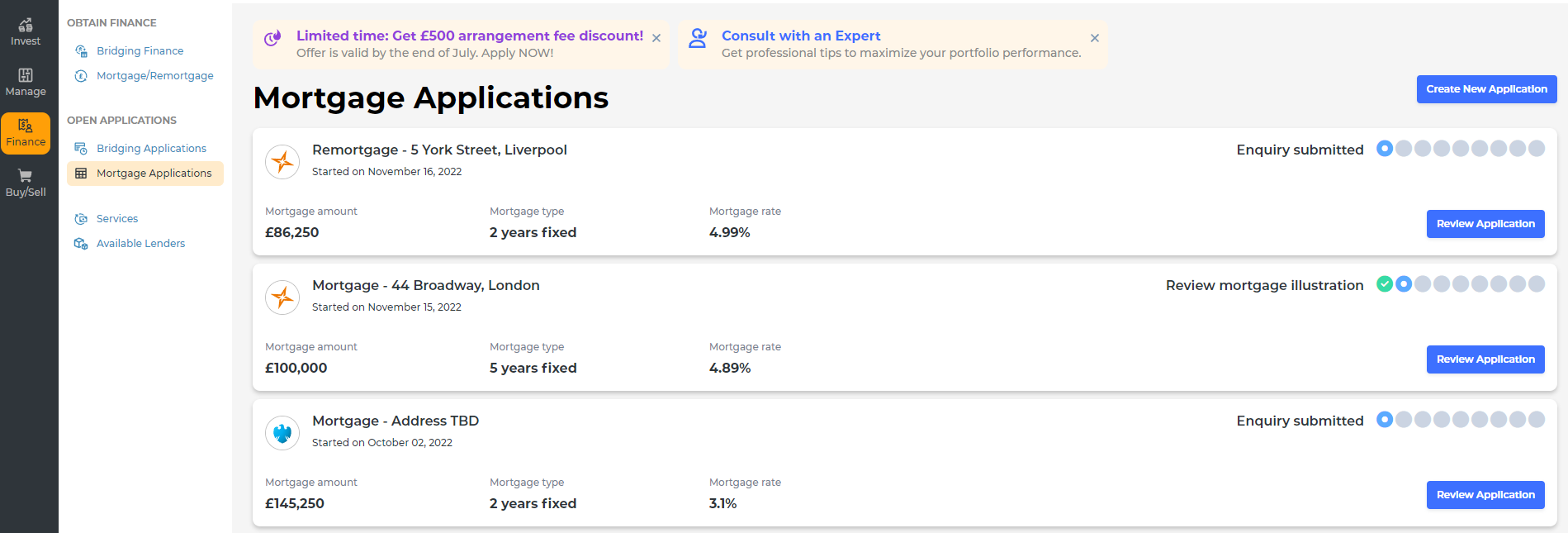

At Lendlord our mortgage experts can guide you in finding the mortgage deal that best suits your needs. Lendlord offers a team of experienced mortgage experts who can provide personalized guidance and support throughout your property investment journey for your next BTL mortgage

Sign Up for Free Today & Get 40% Off Lendlord Premium Plan!