Lendlord Bridging Loan Calculator Review

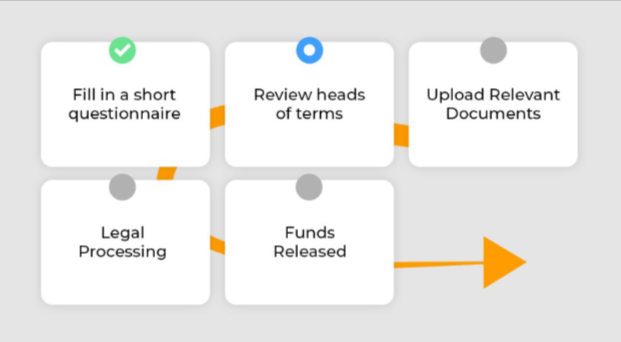

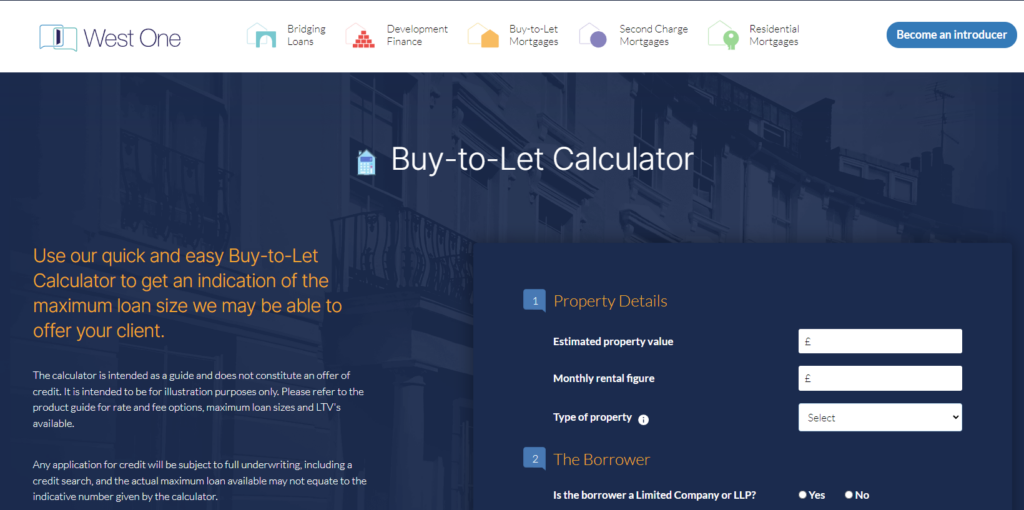

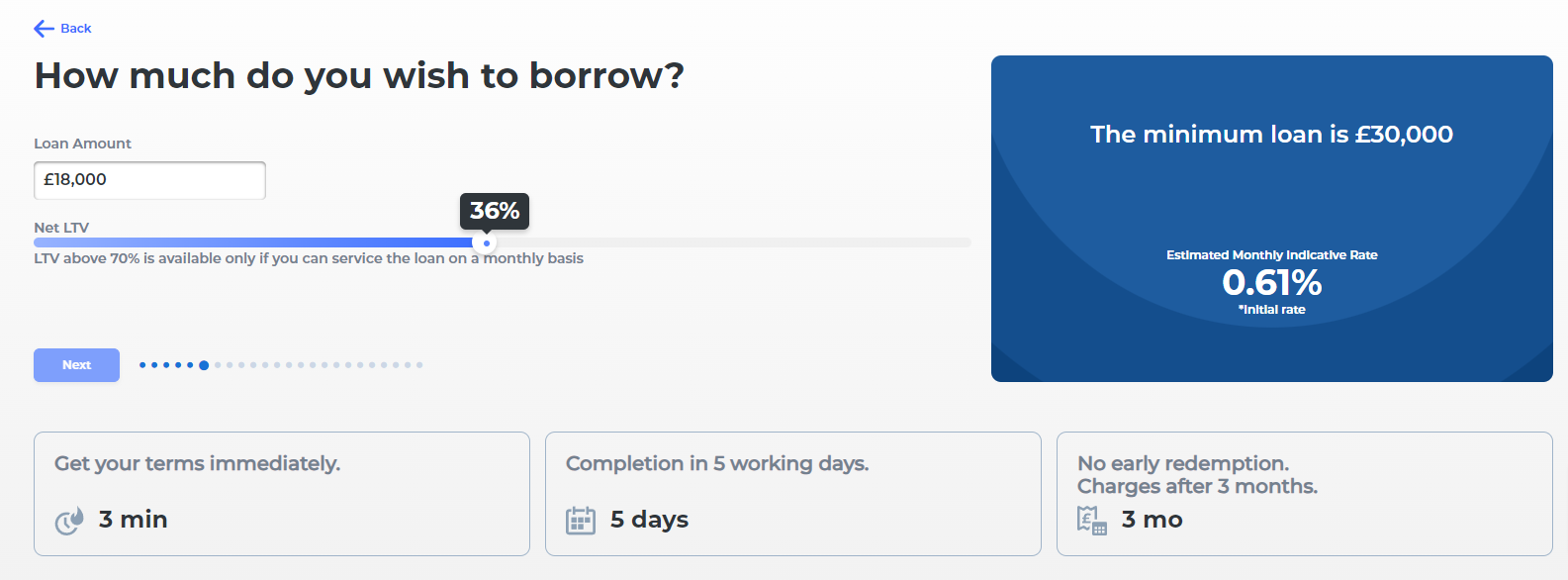

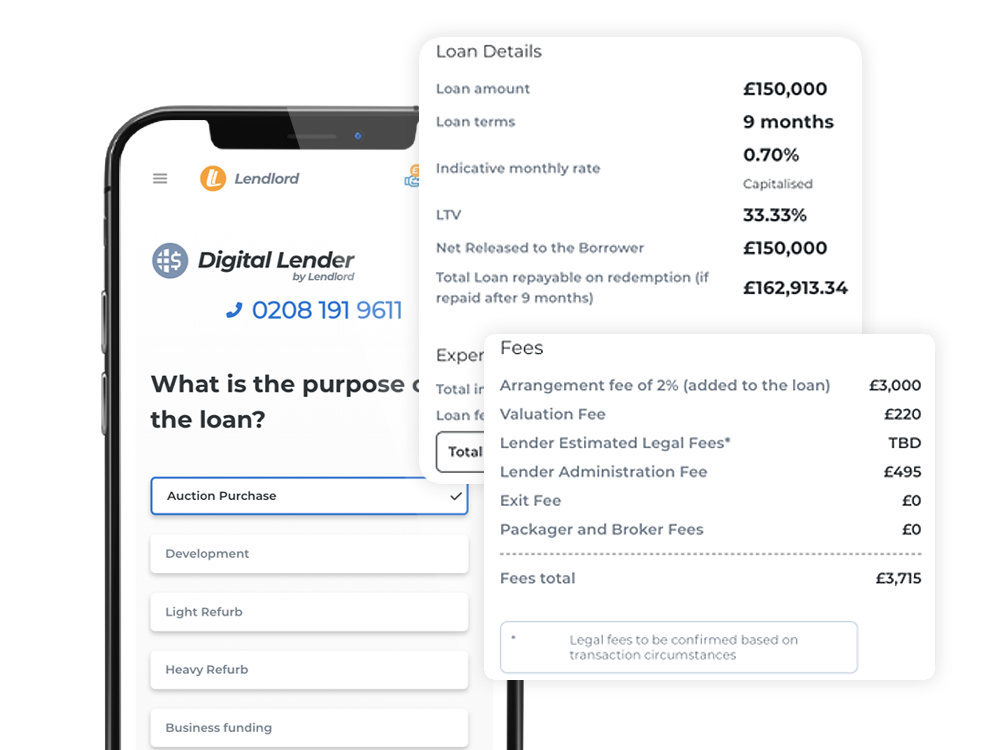

Lendlord’s Bridging Calculator, represents a user-friendly tool aimed at simplifying the evaluation process for potential borrowers considering a short-term financing solution.

This calculator distinguishes itself with a questionnaire design, allowing users to effortlessly provide necessary information through minimal clicks or direct data entry.

It’s tailored to cater to a wide array of inquiries related to bridging loans, from basic calculations on loan costs to more specific criteria regarding borrowing limits and prerequisites.

Key Features and Requirements of the Bridging Loan Calculator:

User Interface: The calculator boasts a questionnaire-style interface, making it straightforward for users to input their financial details and requirements. This design ensures that users can navigate through the process efficiently, entering data such as loan amount, property value, and intended loan duration.

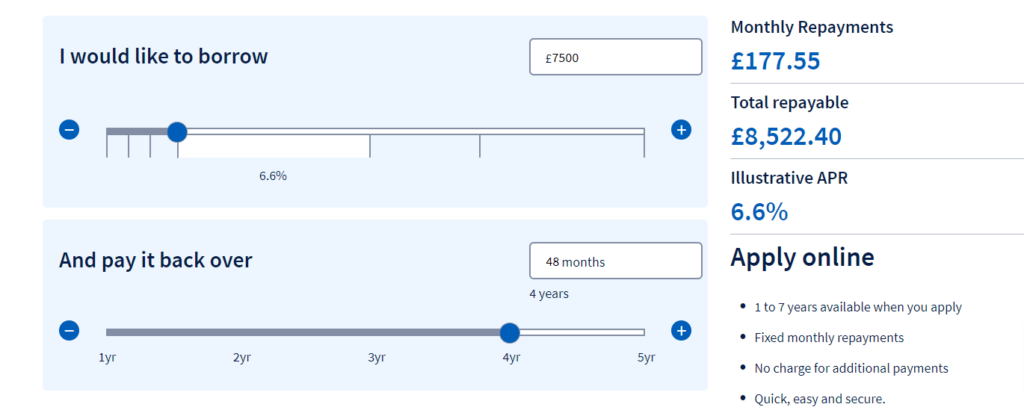

Average Bridging Loan Rate: The calculator starts its interest rate calculations from a competitive rate of 0.6% per month. This enables users to get an approximate idea of the monthly interest costs based on the size of the loan they are considering.

Cost Per Month: The interest cost of a bridging loan is directly calculated based on the loan size. The calculator provides users with an estimate of their monthly interest payments, offering clarity on the financial implications of taking out a bridging loan.

Down Payment Requirement: With Lendlord, the minimum down payment for a bridging loan is set at 25% of the purchase price or market value of the property. This requirement is clearly stated, allowing borrowers to assess their upfront cash needs.

Borrowing Limits: The calculator caters to a broad range of financing needs, with minimum and maximum borrowing limits set at £30,000 and £12 million, respectively. This range accommodates both small and large-scale financing requirements.

Income-Based Consideration: Unlike traditional loans, bridging loans with Lendlord usually do not require income verification. This makes the loan accessible to a wider audience, including those with variable income streams.

Funding Speed: The calculator provides insights into the potential speed of funding, indicating that borrowers could receive the funds within 5 working days. However, the actual timeline can vary depending on the legal process involved.

Documentation: Users are informed of the necessary documentation required for a bridging loan application, including a passport copy, utility bill, bank statement, latest payslip, and credit report. This helps applicants prepare their documents in advance, streamlining the application process.

Repayment Period: The typical repayment period for a bridging loan is up to 12 months, with the possibility of extending up to 18 months in certain cases. This flexibility is beneficial for borrowers planning their exit strategy.

Guarantor and Credit Checks: Generally, a guarantor is not required for a bridging loan. However, a credit report is necessary, indicating that while the loan may not be primarily income-based, creditworthiness is still considered.

This bridging finance calculator

serves as an invaluable tool for individuals and businesses looking to bridge a financial gap, offering a clear and concise pathway to understanding the specifics of bridging loans. By providing detailed insights into the costs, requirements, and processes associated with bridging loans, Lendlord’s calculator empowers users to make informed financial decisions.

Lendlord's Bridging Loan Calculator - Q&A

Startring at 0.6% per month

The interest cost will be calculated based on the loan size

Minimum of 25% of the purchase price / market value

Minimum 30k maximum 12M

Usually not

To get the funds it can be in 5 working days, depends on the length of the legal process

passport copy, utility bill, bank statement, latest payslip and credit report

Typically up to 12 months but it can go to 18 months in some cases

Usually not

Credit report is required