Table of Contents

Buy to Let Is It Worth It ?

Investing in buy-to-let properties in the UK is a popular strategy for generating passive income and building wealth. With fluctuating property prices and changing regulations, potential investors often wonder: is buy-to-let still worthwhile?

From understanding mortgage rates and rental yields to navigating the complexities of the market, this article explores how buy-to-let investments are viable.

The pros and cons of buy-to-let properties will be discussed, along with financial considerations and tips on where to invest. Your financial goals and market expectations can help you determine whether buy-to-let investments are right for you by examining these factors.

Investing in buy-to-let properties

The UK buy-to-let property market can generate income and serve as a means of accumulating long-term wealth. Consider these three key points:

Rental Income: Buying and renting properties provides landlords with a regular source of income. The income can cover mortgage payments and other expenses, potentially leaving a profit.

Capital Growth: Property values in the UK can increase over time, providing investors with capital growth. The overall return on investment can be significantly enhanced by this appreciation.

Tax Considerations: There are tax considerations for landlords in the UK, including stamp duty and capital gains tax, which can affect profitability. Tax planning and consulting with a tax advisor can optimize tax efficiency.

Property tribes and lendlord – buy to let deals solved by data

What Is Buy to Let?

Buying a buy-to-let property and renting it to tenants provides income from rent while building equity. The strategy attracts investors seeking financial gains through real estate in the UK.

Profitability is influenced by buy-to-let mortgage rates and rental yields. Optimizing returns requires understanding tax implications, including buy-to-let stamp duty.

Properties in high-demand areas often yield better returns because of their location. Tax benefits are one of the reasons why many investors consider forming a buy-to-let limited company.

Keeping up with market trends and regulations helps investors maximize their buy-to-let investments.

Pros and Cons of Buy to Let Properties

There are benefits and challenges to investing in buy-to-let properties. Passive rental income and property appreciation are positive aspects of owning a rental property. Long-term wealth can be built through these investments by diversifying portfolios.

There are, however, risks investors should consider, such as market fluctuations and void periods, which will impact their returns. Buy-to-let mortgage rates and associated costs, like maintenance and management fees, can reduce profitability.

Landlords face regulatory changes and tax obligations, such as buy-to-let stamp duty and capital gains tax, affecting financial outcomes. Considering these pros and cons will assist investors in determining if buy-to-let investments are a good fit for their financial goals and risk tolerance.

Buy to Let Investment Strategies

Successful buy-to-let investment strategies involve careful planning and market analysis. Selecting high-demand locations can maximize rental income and capital appreciation. Market fluctuations are reduced when your portfolio is diversified. Investors should compare buy-to-let mortgage rates to secure favorable terms.

Rent yields are evaluated to ensure positive cash flow and profitability. You may be able to enjoy tax benefits by forming a limited company for buy-to-let properties. Keep an eye on market trends to adapt your strategy.

The better you understand tenant preferences, the higher your occupancy rates and your return on investment. Property management, whether self-managed or through agents, impacts overall success. It is crucial to assess these elements thoroughly in order to formulate effective buy-to-let strategies that align with financial objectives.

Buy to Let for First-Time Buyers

For first-time buyers, entering the buy-to-let market presents unique opportunities and challenges. Securing competitive buy-to-let mortgage rates is crucial for profitability. Thorough research on location helps identify high-demand areas, maximizing rental yields.

Tax implications, including buy-to-let stamp duty and income tax, are vital to financial planning. To maximize tax efficiency, first-time investors should also consider buying through a limited company.

Effective property management and tenant screening contribute to success and long-term growth in this competitive sector.

Financial Considerations in Buy to Let

Financial considerations in buy-to-let investments are crucial for ensuring profitability and sustainability in the UK market. Here are three important factors to keep in mind:

Mortgage Rates: Buy-to-let mortgage rates in the UK are generally higher than residential rates, and securing a favorable rate can significantly impact your returns. Comparing rates and understanding fixed versus variable options are essential steps.

Costs and Fees: Investors should account for various costs, including maintenance, letting agent fees, and insurance. These expenses can affect the net rental income and overall profitability of the investment.

Implications for taxes: Renters must understand tax obligations such as income tax and stamp duty. For potential tax savings, investors should consider holding properties through a limited company.

Buy to Let Mortgage Rates UK: What to Expect

There are several factors that determine buy-to-let mortgage rates in the UK, including loan-to-value ratios and borrower creditworthiness. Due to perceived risks, these rates are typically higher than standard residential mortgages.

A fixed-rate option and a variable-rate option are both available, each with its own benefits. Variable rates offer lower initial costs than fixed rates. Arrangement fees impact overall expenses for investors. Regularly comparing rates helps identify the most competitive deals.

Monitoring economic conditions and interest rate trends is essential for informed decisions. Understanding these dynamics enables investors to optimize buy-to-let financing and enhance investment returns.

Calculating Buy to Let Rental Yield

Assessing investment potential requires calculating buy-to-let rental yield. By multiplying annual rental income by property purchase price, you can determine yield.

This percentage indicates return on investment. A high rental yield signifies better cash flow, attracting investors seeking steady income. Yields are influenced by factors such as location and property type. Comparing yields across regions helps identify lucrative opportunities.

Additionally, factoring in expenses like maintenance and insurance provides a clearer picture of net yield. In the competitive UK market, investors need to be able to understand these calculations to make informed investment decisions.

Costs and Fees in Buy to Let Mortgages

Costs and fees in buy-to-let mortgages significantly impact investment returns. Arrangement fees, often a percentage of the loan, add to upfront costs. Valuation and legal fees further increase initial expenses.

Monthly interest rates, higher than residential loans, affect cash flow. Maintenance costs and letting agent fees reduce rental income. Buy-to-let stamp duty and potential capital gains tax influence overall profitability. Calculating these expenses helps investors evaluate financial viability.

Comparing deals using a buy-to-let mortgage calculator aids in finding the most cost-effective option. Understanding these costs ensures better financial planning and successful property investment in the UK market.

Buy to Let Interest-Only Mortgage Calculator

A buy-to-let interest-only mortgage calculator is an essential tool for investors seeking to evaluate potential returns. It calculates monthly payments by considering loan amount, interest rate, and term. Interest-only mortgages reduce initial monthly costs, enhancing cash flow.

Investors can redirect savings toward other opportunities or property improvements. Understanding the total interest payable over the loan’s duration helps assess long-term viability. This calculator also illustrates how changes in interest rates impact expenses.

Comparing different mortgage scenarios enables investors to make informed decisions. Exploring these calculations reveals opportunities for maximizing returns and optimizing buy-to-let investment strategies in the UK property market.

Getting the most out of your buy-to-let investment

In order to make a successful investment in the UK’s buy-to-let market, careful planning and informed decision-making are essential. You should consider the following three strategies:

Location Selection: Choosing the right location is crucial. Areas with high rental demand, such as university towns or major cities, can offer better rental yields and lower vacancy rates.

Regulatory Compliance: Staying informed about UK regulations, such as tenancy laws and energy efficiency requirements, is essential to avoid legal issues and maintain a compliant rental property.

Market Trends: Keeping an eye on market trends, such as interest rate changes and housing market shifts, can help investors make timely decisions and adapt strategies to maximize returns.

Best Areas for Buy to Let Properties in the UK

Identifying the best areas for buy-to-let properties in the UK involves evaluating rental yields, demand, and growth potential. Northern cities like Manchester and Liverpool offer attractive yields due to affordable property prices and strong tenant demand.

London remains a popular choice for capital appreciation despite lower yields. University towns such as Nottingham and Bristol provide stable rental income from student populations.

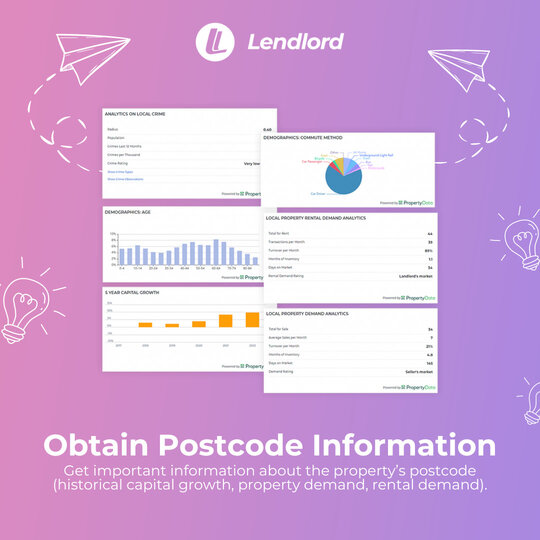

Analyzing local amenities, postcode information, transport links, and employment opportunities can enhance investment prospects. Understanding regional market dynamics helps investors pinpoint lucrative locations.

Exploring these areas equips landlords to capitalize on emerging trends and maximize returns in the competitive buy-to-let sector.

Property Deal Analysis & Postcode Information Analysis With Jamie York

Buy to Let Limited Company vs. Personal Investment

Choosing between a buy-to-let limited company and a personal investment involves assessing tax implications and financial goals. Limited companies benefit from corporate tax rates, reducing overall tax liability.

Investors can also offset mortgage interest against profits, enhancing tax efficiency. Personal investments, however, offer capital gains tax allowances and simplify management for smaller portfolios. Establishing a limited company entails additional administrative costs and responsibilities.

The optimal structure is determined by analyzing rental income, property values, and long-term strategies. Comparing the benefits and drawbacks equips investors to align buy-to-let investments with their financial objectives, maximizing returns in the UK market.

Future Trends in the Buy to Let Market

Future trends in the buy-to-let market highlight evolving dynamics in the UK property sector. Rising interest rates may influence mortgage costs and rental yields. Increasing regulations, such as energy efficiency standards, impact property management practices.

The growth of remote working fuels demand for suburban and rural rentals. Technology adoption, including online platforms, streamlines tenant interactions and property management. Environmental considerations encourage sustainable building features in rental properties.

Demographic shifts, like aging populations, drive demand for accessible housing. Adapting to these trends requires strategic planning and flexibility. Staying informed enables investors to optimize buy-to-let strategies and maintain competitive advantages in this changing market.

Buy to Let Property Investment Tips

Choose properties in high-demand areas with strong rental markets, such as city centers or university towns, and set competitive rental prices.

Evaluate local amenities, transport links, employment opportunities, and demographic trends to identify areas with potential for rental growth and tenant demand.

Regularly review and adjust rent based on market conditions, minimize void periods through effective marketing, and manage maintenance costs efficiently.

Consider tax implications and administrative costs. A limited company may offer tax advantages but involves more complexity in management.

Efficient property management ensures tenant satisfaction, timely maintenance, and reduced vacancy rates, contributing to consistent rental income.

Compare buy-to-let mortgage rates and options, including interest-only and fixed-rate mortgages, to find the best fit for your financial goals.

Understand buy-to-let stamp duty, income tax on rental earnings, and capital gains tax, and explore tax relief opportunities to optimize returns.

Stay informed about regulatory changes, economic trends, and tenant preferences, allowing you to make proactive adjustments to your investment strategy.

Avoid over-leveraging, neglecting property maintenance, and underestimating costs. Thorough research and financial planning mitigate risks.

Use online platforms for tenant screening, rent collection, and maintenance requests to streamline operations and improve tenant satisfaction.

Insights into the Buy-to-Let Landscape: Final Thoughts

The buy-to-let landscape requires informed decision-making and strategic planning. Understanding financial considerations, including mortgage options and tax implications, is crucial for maximizing returns.

Selecting the right location and adapting to market dynamics offers a competitive edge. Future trends, such as remote working and environmental considerations, present opportunities for innovation.

Landlords should remain proactive, using resources like postcode information and rental yield calculators to enhance outcomes. By embracing these insights, investors can effectively navigate the complexities of buy-to-let investments and achieve their financial objectives in a rapidly changing market.

Sign Up for Free Today & Get 40% Off Lendlord Premium Plan!