How Skipping Research Can Lead to Bridging Loan Regrets

The “Oops, I Forgot to Do My Homework” Blunder Picture this: You’re so excited about your new property deal that you jump into a bridging loan faster than a caffeinated kangaroo. Congratulations! You’ve just won a one-way ticket to Regretsville, population: you. Remember, folks, research isn’t just for nerds and librarians – it’s for anyone who doesn’t want to end up living in a cardboard box.

How to Develop a Reliable Exit Plan

Some people think an exit strategy is something you do when your in-laws stay too long.

In the world of bridging loans, it’s your ticket to financial freedom. Without one, you might as well be playing financial Russian roulette with a fully loaded gun. Don’t be that guy who ends up selling a kidney to repay the loan!

Exit Strategies: Your Safety Net in the World of Bridging Loans

A reliable exit strategy for property investment in the UK is essential, as well as an assessment of the market conditions, the establishment of clear financial objectives, and the identification of potential buyers or refinance options.

The best way to minimize risks and maximize returns on your investments is to ensure legal compliance and consult with financial advisors in order to tailor strategies.

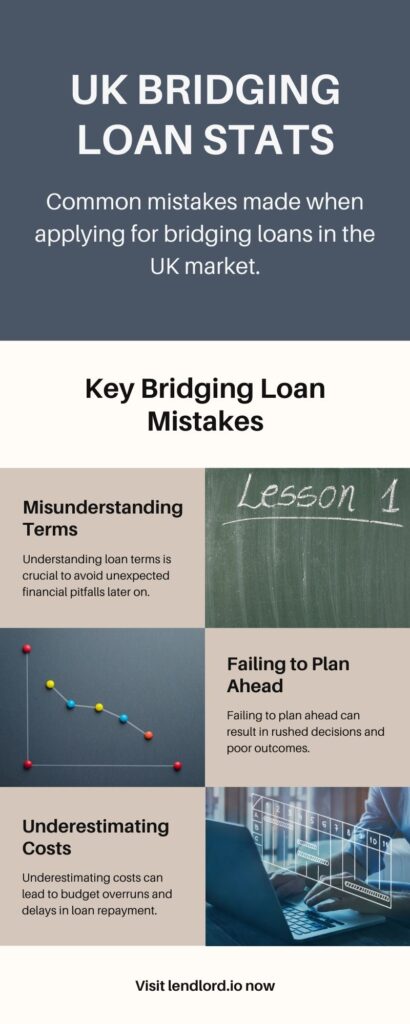

Bridging Loans: Hidden Fees and Unexpected Costs

Surprise! You thought you were signing up for a bridging loan, not a treasure hunt for hidden fees.

Surprise! Those sneaky little costs lurk in the shadows, ready to pounce on your bank account and yell “Boo!” It’s time to channel your inner Sherlock Holmes and uncover those mysterious charges before they find you.

Why the Fine Print is Crucial in Bridging Loan Contracts

“I Don’t Need No Stinkin’ Fine Print” Fiasco Ah, the fine print – that tiny text at the bottom of the contract that might as well be written in ancient Sumerian. The same as skydiving without checking your parachute is ignoring it. Sure, it might work out, but do you really want to take that chance? Spoiler alert: You don’t.

Why Borrowing More Than Necessary Can Lead to Financial Trouble?

If a lender offers you enough money to buy a small country, that doesn’t mean you should take it. There are consequences to taking out a bridge loan – it’s not like eating at an all-you-can-eat buffet. Stay focused on what you need, otherwise you will end up with a financial food coma.

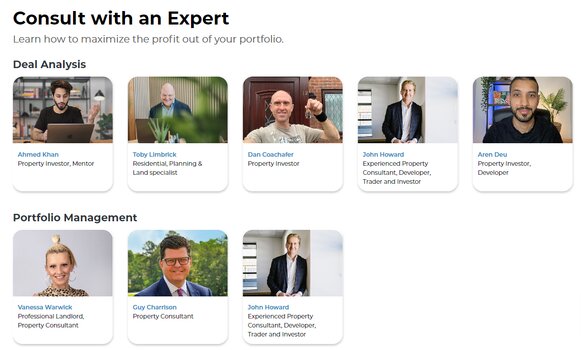

The Dangers of Overconfidence: Why Professional Advice Matters

The hubris of “I’m a Financial Genius, I Don’t Need Help” Sure, you have watched all seasons of “Shark Tank” and you are able to quote “The Wolf of Wall Street” off the top of your head.

It does not mean, however, that you are a financial wizard. Don’t let your pride prevent you from seeking professional advice from a property investment consultant. It’s cheaper than the therapy you’ll need after you mess up your bridging loan.

Why Meeting Bridging Loan Deadlines is Non-Negotiable?

In the world of bridging loans, time is money – literally. This is why the misconception that “Time is a Social Construct” has become so widespread.

The concept of thinking that you can casually stroll past the deadline when it comes to repaying your debt is like trying to sweet-talk a hungry tiger.

The bottom line is that you and your wallet are not going to be pleased with the outcome.

Don't Get Caught Off Guard: Verify Your Property Before Committing

Overlooking the “Property? What Property?”

Issue Some people are so caught up in the excitement of a free loan (newsflash: it’s not free) that they forget to check out the property that they’re going to buy before they commit.

You don’t want to be the person who ends up with a lovely bridge to nowhere or a charming house of horrors as the result of your negligence.

Avoid Costly Surprises: The Importance of Accurate Property Valuation

There is a saying: “Valuation Schmvaluation” That goes like this: Getting a proper valuation is like going to the doctor and getting a checkup.

You might find it a bit painful to go through this process, but it’s better than being shocked to find out your investment is worth about the same as a used toothbrush. Don’t let your optimism lead you to write checks that your property will not be able to cash!

Why Proper Property Valuation is Crucial for Smart Investments

The “I’ll Cross That Bridge When I Come To It” Mentality Spoiler alert: You’re already on the bridge, Captain Procrastination! Failing to plan for potential hiccups is like going on a road trip without a spare tire. You might make it, but do you really want to take that chance with your financial future?

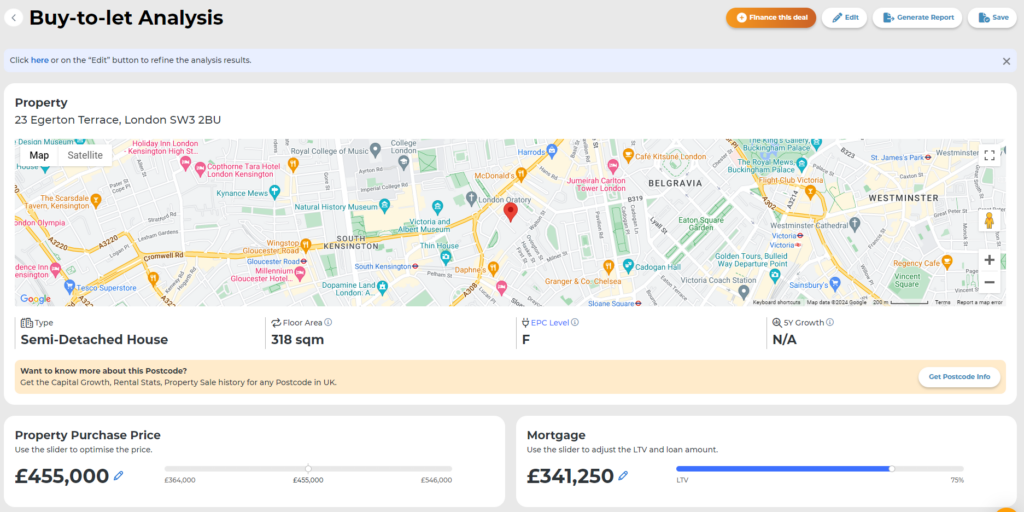

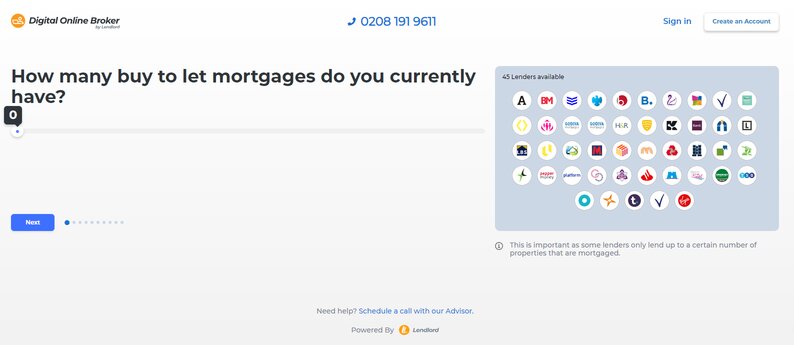

Calculators for bridging loans and mortgages

Calculators for bridging loans and mortgages are essential tools for property investors. By estimating costs accurately, you can assess financial viability and plan repayments.

Your investment strategy will be optimized when you use these calculators, reducing the risk of costly mistakes, and reducing the risk of costly mistakes.

Investing smartly requires proper property valuation

Smart investments require proper property valuation so that you pay a fair price, understand the potential return, and secure financing.

By avoiding overpaying and identifying lucrative opportunities, accurate valuations safeguard your financial interests and maximize investment returns.

Q&A

A common mistake is getting the numbers wrong, which includes overpaying for a property, underestimating refurbishment costs, and failing to account for additional expenses like stamp duty, taxes, and valuation fees

An exit plan is essential because it outlines how you will repay the loan at the end of its term. Without a solid exit plan, you risk falling behind on repayments and potentially losing your property

There is a possibility of running out of funds quickly if cash flow is mismanaged, especially if project costs overrun. There can be significant pressure placed on profit margins and the overall viability of the project as a result.

The failure to conduct a thorough property inspection can end up costing you money, such as not obtaining planning permission, uncovering structural problems, or locating hazardous materials such as asbestos.

Choosing an unqualified surveyor for the valuation of your property can result in financial losses when you decide to rent or sell it, since the amount of your loan and the potential earnings are based on the value of your property

In my experience, a common mistake is not conducting due diligence before purchasing a property, which includes researching the property thoroughly and understanding all of the legal implications and costs associated with the purchase.

In the event that you do not pay attention to hidden costs such as additional fees, legal costs, and valuation expenses, they will quickly add up and strain your finances, resulting in unexpected financial problems

If you want to avoid unexpected complications, it is crucial that you read the fine print of the contract to ensure that you are fully aware of all the terms and conditions, including all prepayment penalties, interest calculation methods, and default clauses.

If you borrow more than you need, you may suffer unnecessary debt and financial strain, making it harder to manage repayments and increasing overall expenses.

You can find valuable insight, obtain better understanding of complex terms, and make well-informed decisions by consulting with financial advisors, mortgage brokers, or lawyers

There you have it, folks – the top 10 bridging loan mistakes that can turn your financial dreams into a comedy of errors. Remember, in the world of bridging finance, ignorance isn’t bliss – it’s expensive. So, do your homework, plan ahead, and for goodness’ sake, read the fine print. Your future self (and your bank account) will thank you!

Now, go forth and bridge responsibly. And if all else fails, there’s always that cardboard box we mentioned earlier. It’s cozy if you decorate it right!