We have just published a new article for the Property Reporter: “Are your properties still a viable investment?”

In this post we would like to show you how you can use Lendlord in order to be on track on the performance of your properties.

Data from the National Residential Landlords Association (NRLA) has revealed that 22% of landlords have lost rental income as a result of the pandemic, with 3% of landlords saying they have lost more than half their rental income as a result of COVID-19.

In this environment, where there is so much uncertainty for landlords to navigate, it is more important than ever that they stay on top of the information they do have, to ensure they are putting their investment in the best possible position to survive and thrive.

So, as a landlord, what metrics should you be aware of, and how can you track them?

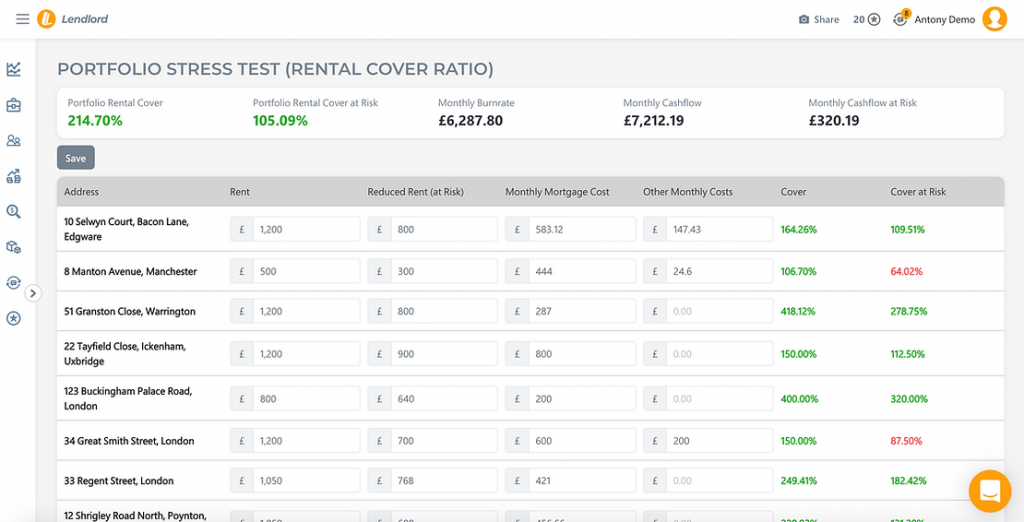

The first thing to know is your Rental Cover Ratio. This is how much runway you have if your tenants stop paying rent altogether or start paying a reduced rent, perhaps at Local Housing Allowance or Universal Credit rates. It is important to analyse this and measure your cash burn rate so that you can ensure you remain comfortable you have enough cash in extreme cases.

In order to measure your Rental Cover Ratio on Lendlord you should go to the Portfolio Stress Test Page:

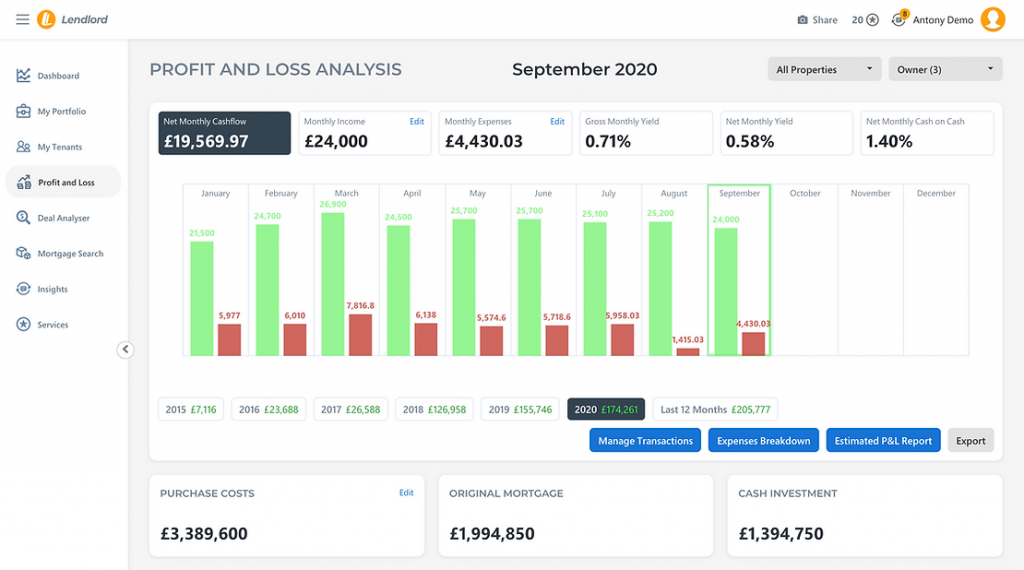

Net cash flow Vs. Gross cash flow. It’s really important for landlords to track their monthly expenses on each property and on the entire portfolio on an ongoing basis and measure the net cash flow and the “Cash on Cash” return. This shows the cash return on the investment as a percentage and can help you to make a more informed judgement as to whether or not the investment is still working in your favour.

On Lendlord you can track your Monthly Income and expenses and review your Net Cashflow and Cash on Cash metric overtime on each property and on the entire portfolio:

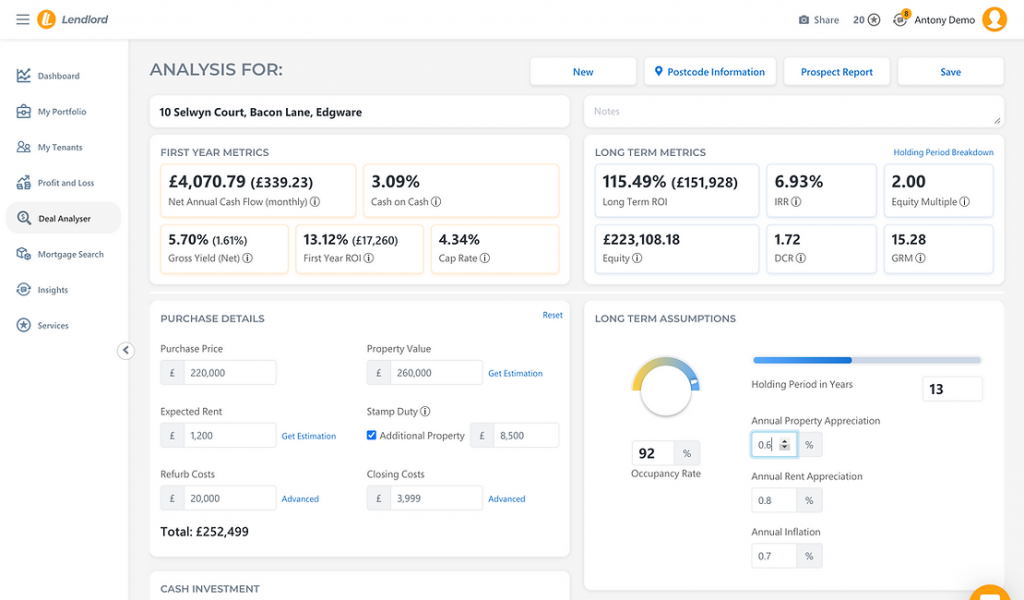

Evaluate your property for the long run. What are your assumptions in terms of property price appreciation, rental appreciation and inflation? You should carry out due diligence from time to time on the prospects for the areas in which your properties are located and change the assumptions according to the most up-to-date outlook.

Once you have done this, you should take a look at how these assumptions impact your long term metrics to help you review the future opportunity for your properties.

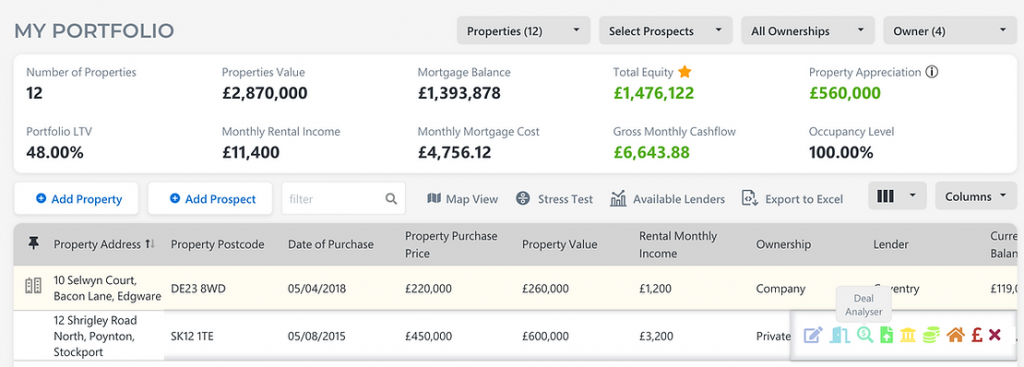

In order to evaluate your existing properties for the long run on Lendlord, you should hover over the property row on My Portfolio and click on Deal Analyser:

In the Deal Analyser page you can make your assumptions for the long term and review the different metrics for an existing property and for a prospect property:

When it comes to analysing a new potential acquisition, don’t just consider that property in isolation, but take a holistic view of how your entire portfolio will look if your purchase that particular property.

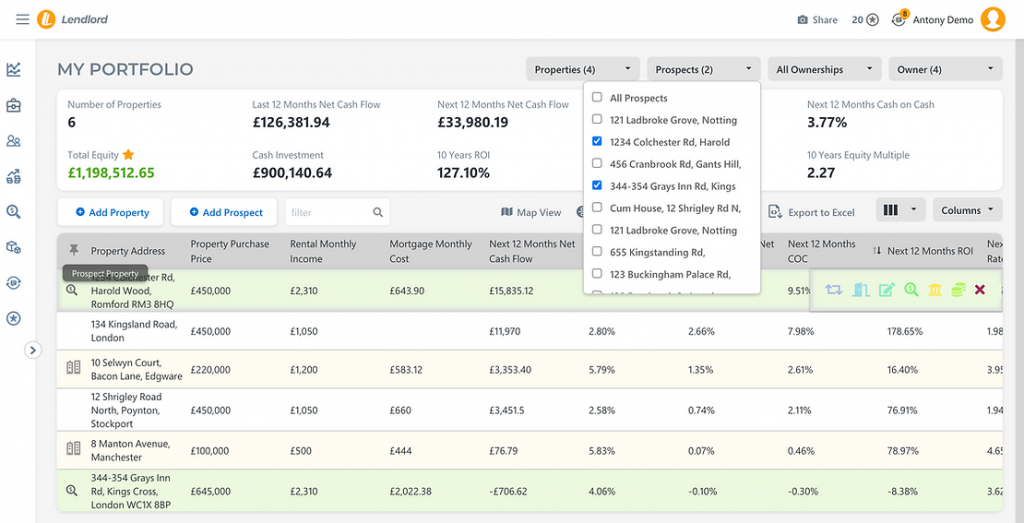

On Lendlord you can manage all your prospect properties in one place and run “What If” Scenarios.

You just need to play with the different filters on My Portfolio and see how your portfolio will look in different scenarios:

You can watch our latest webinar on this topic as well:

Sign In or Sign Up today and understand if your properties are viable investments.