As a Landlord you need to make sure your property business is profitable and is running with a low risk. It is very hard to do it without tracking all of your income and expenses on an ongoing basis and review your metrics.

This week we have released a new version with the ability to link your bank accounts to your Lendlord account and by that automating your properties cash flow and your bookkeeping without the worry of missing any transaction.

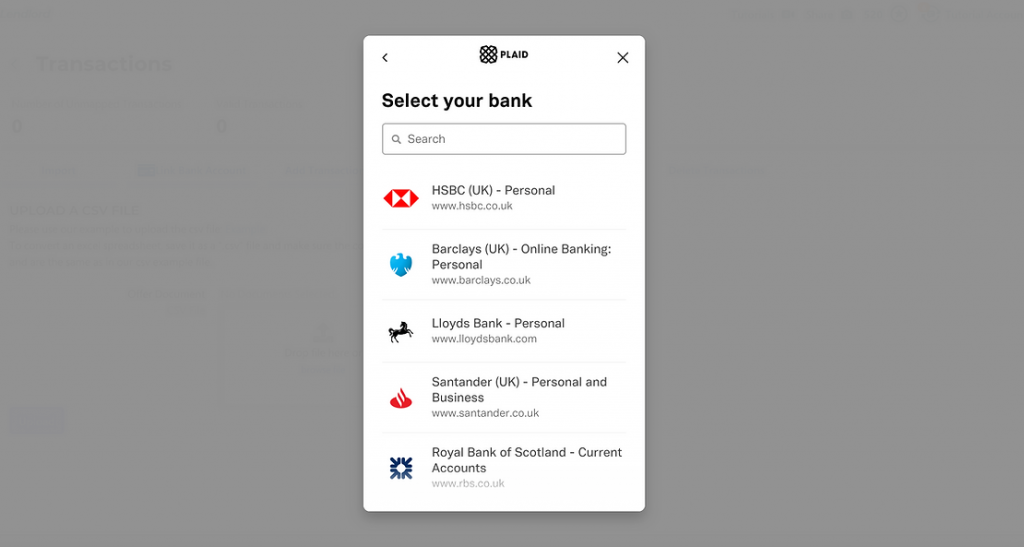

In order to allow for the linking of accounts, Lendlord partnered with Plaid, an authorised open banking player authorised and regulated by the FCA.

So how it works?

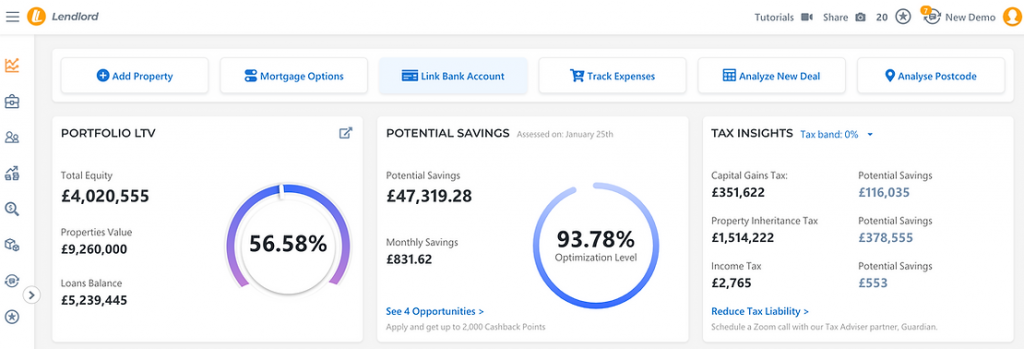

From your dashboard, click on “Link Bank Account” and subscribe to the open banking plan:

Use Plaid wizard to link your bank account (the communication is secured and we don’t keep any of your credentials):

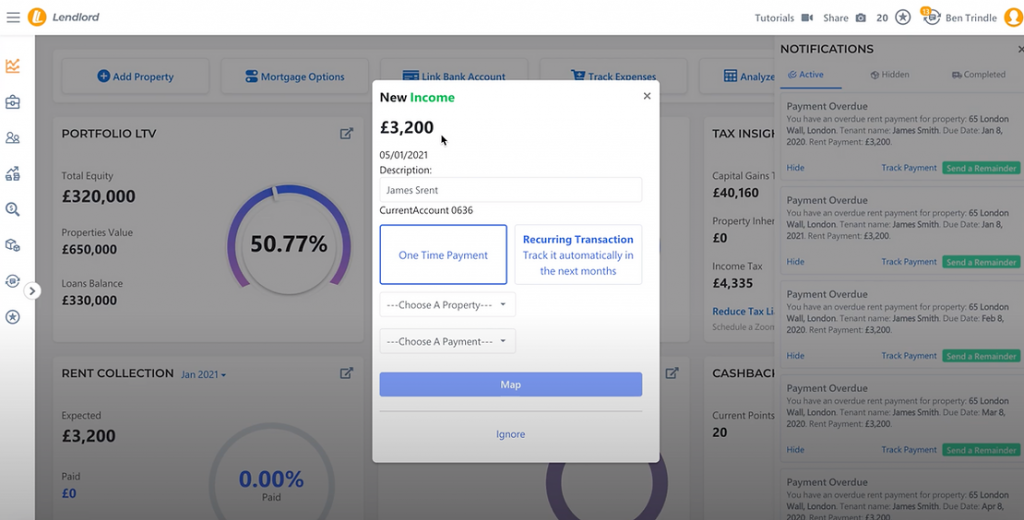

Start to map your bank transaction to the relevant properties and to the relevant tenant (don’t worry, next time the platform will do it for you, so you’ll just need to review).

Starting this point, every day the platform will retrieve any new transaction from your bank account so you won’t miss anything:

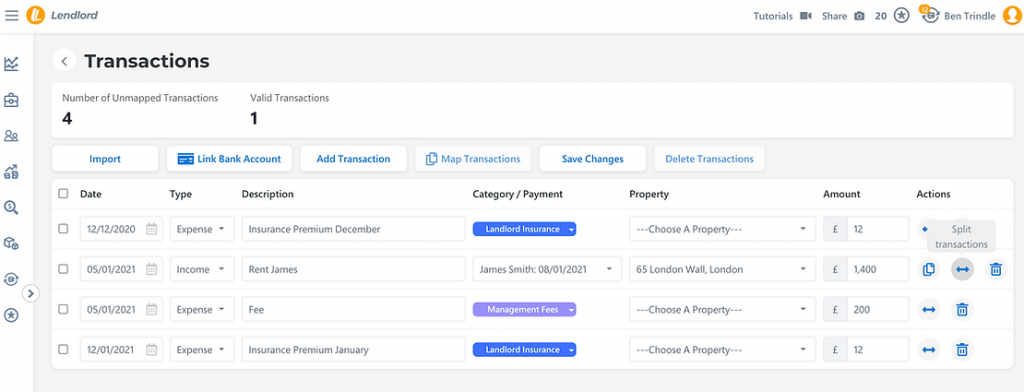

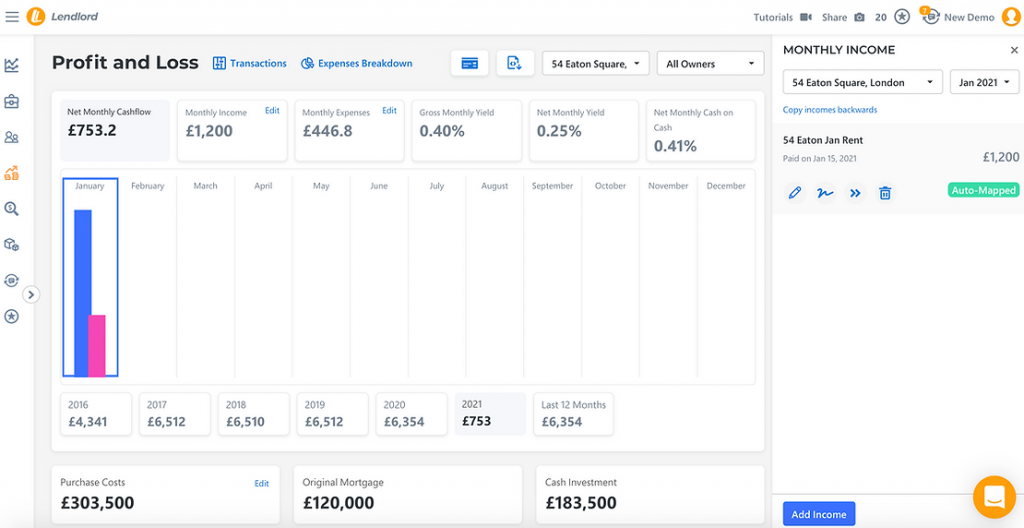

If you want, you can skip the Wizard and map all the transactions from the Transactions page (there, you can also split 1 transaction into many). You can access the Transactions page from the Profit and Loss page:

Review your up to date Profit and Loss for your entire portfolio:

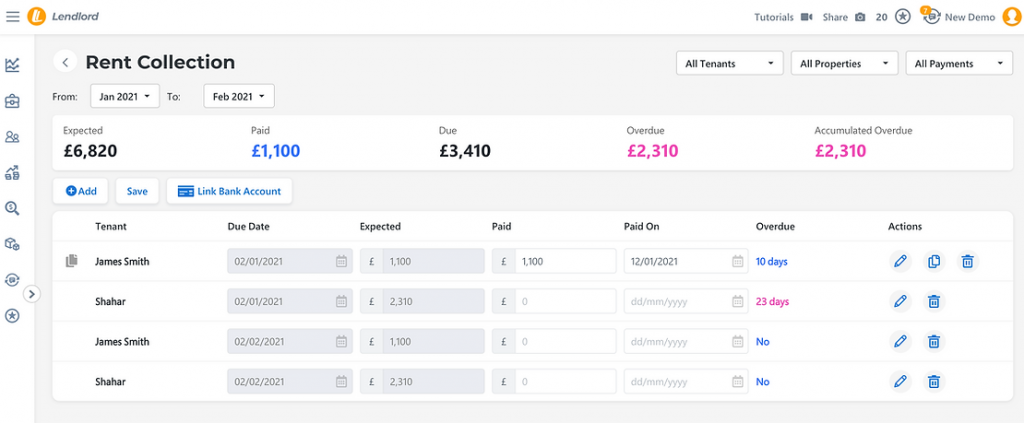

Review your Rent Collection status:

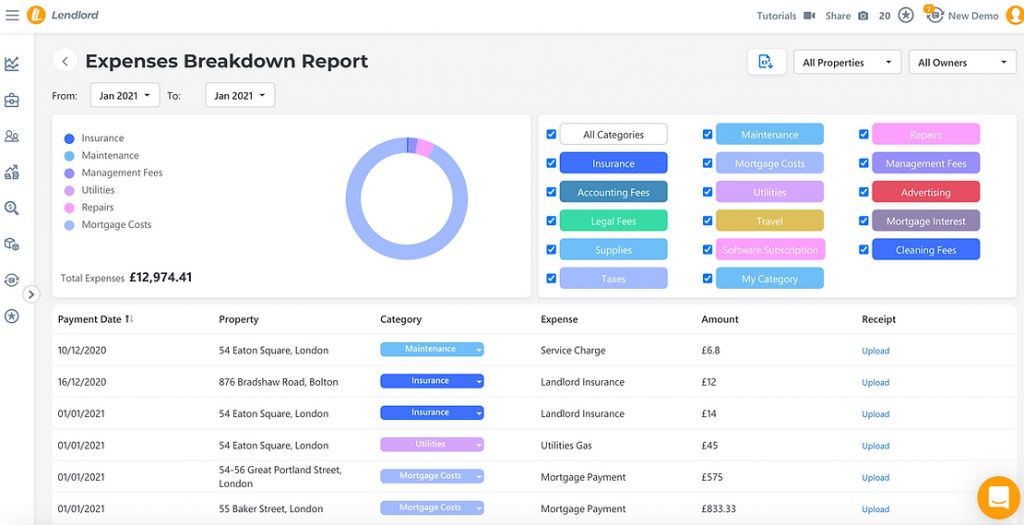

Review your Expenses Breakdown:

Sign In or Create a Lendlord Account and start automating your cash flow!