We have just published a new article for the Property Reporter: “Top 6 considerations when arranging finance for your portfolio”.

In this post we would like to show you how you can get the right information when taking finance using Lendlord.

Arranging the right finance is a key element to any successful property investment, but it can also be a tough task. There is no one perfect product that is right for everyone.

Indeed, there are hundreds of lenders and thousands of products. Each lender has its own criteria and pricing, and changes these on a regular basis depending on its own risk appetite – so, how can you identify the best of these for your individual circumstances, which will also change frequently?

Here are the six main criteria items that lenders consider when assessing a mortgage application for an investment property:

1. How many Buy to Let mortgages do you already have?

There are lenders that won’t lend if you already have more than three Buy to Let mortgages, some will limit it at five, and some at 10. However, there are several specialist lenders which will lend even if you have more than 10 Buy to Let mortgages.

2. Total mortgage balance

Lenders will also look at the total outstanding mortgage balance across your entire portfolio – and some will put a limit on the amount they are prepared to consider. Additionally, some lenders limit the total amount they will lend to an individual borrower – person or limited company – across the entire portfolio. So, if you already have mortgages with a lender, there is a chance it won’t be prepared to lend any more.

3. Portfolio LTV

The average LTV across a portfolio is a good indicator of present and future risk, plus outstanding liabilities and lenders will often take a look at a landlord’s average portfolio LTV and base any decision around this information.

Generally speaking, the lower the LTV across the portfolio, the more comfortable lenders will be about future lending, and this will usually be reflected in the kind of rates on offer. Lower LTVs will also help open the doors to capital raising opportunities which could be useful to quickly make the most of opportunities, which can often arise during uncertain times.

4. Property ICR (Interest Cover Ratio)

Interest Cover Ratio (ICR) is a stress test against different rates of interest and most lenders will run this test to confirm whether or not the rental income will cover the mortgage costs for the property should interest rates increase to a certain level. Lenders have different criteria around the stress that they apply.

5. Portfolio ICR (Interest Cover Ratio)

Portfolio ICR stress tests the entire portfolio against different rates of interest, rather than a single property, and this is another important consideration for lenders.

6. Minimum Income

How much money you earn, aside from rental income from your property portfolio, is another key consideration for lenders. Many lenders will want to see a minimum income of at least £15,000, but there are lenders that will want evidence of a higher level of income.

There are other checks that lenders carry out before making a decision, such as confirming credit history and property valuation, but these are six of the most important considerations. As you can see, it’s a lot of information to digest. All of these factors interlink in different ways, and lenders will have different criteria for each – it’s a huge amount to process to identify the best option to finance your portfolio.

So How I can get this information using Lendlord?

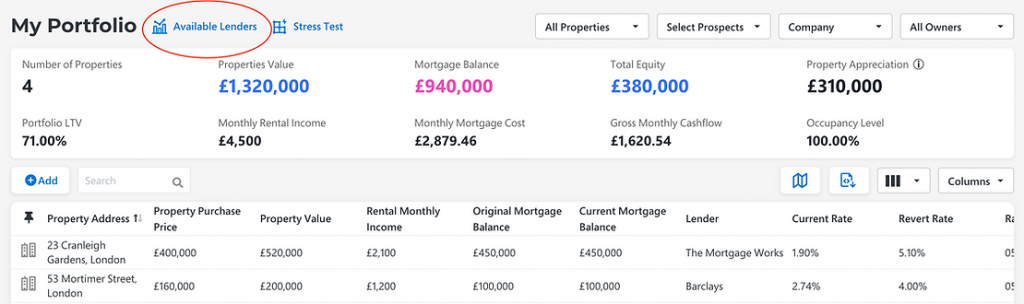

Login to your Lendlord account (or signup here) go to “My Portfolio” and click on the “Available Lenders” link:

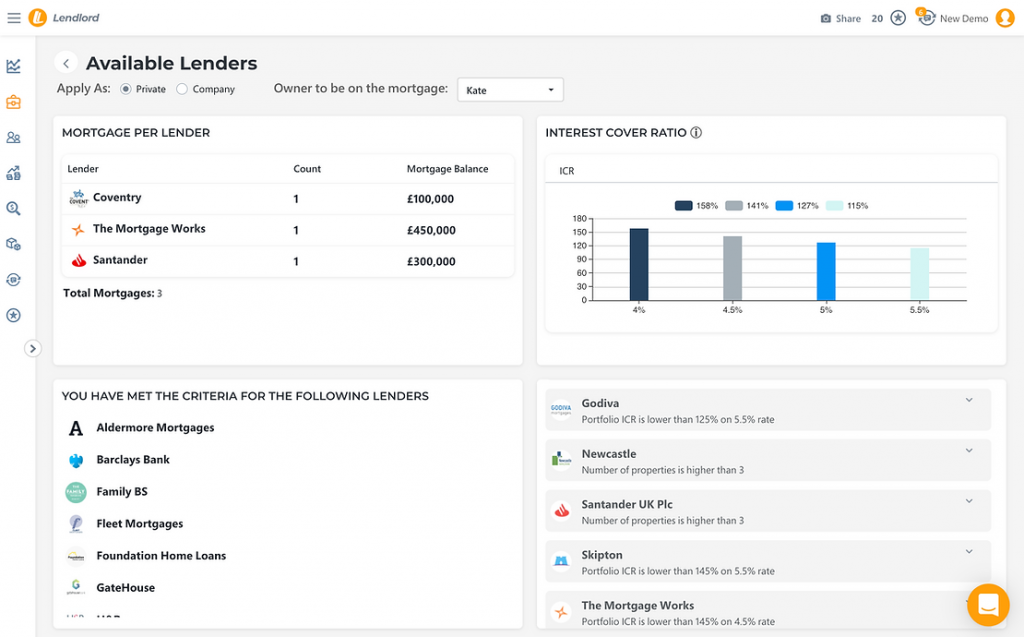

In the available lenders page you can see your mortgage balance per lender, your portfolio ICR number and a list of lenders that are available for your next buy to let mortgage/remortgage and a list of lenders you haven’t met their criteria with the reason why:

Sign In to check which lenders available for you or Create a Lendlord Account