Sign Up for Free Today & Get 40% Off Lendlord Premium Plan!

48,678

By Eli Edri. Updated at 2:52 PM EDT, 3/12/2024

Stamp Duty Land Tax (SDLT) is a tax levied by the UK government on property and land transactions. It applies when purchasing property or land over a certain value in England and Northern Ireland. To determine what you might owe, you can use a stamp duty calculator to estimate the amount based on the property’s purchase price and current tax bands. The purpose of SDLT is to generate revenue for public services and regulate property market activity.

The SDLT rates for residential properties vary based on the property price and buyer type. The standard SDLT rate is tiered, meaning different portions of the property price fall into different tax bands:

Up to £250,000: 0% (No SDLT is payable)

£250,001 – £925,000: 5%

£925,001 – £1.5 million: 10%

Over £1.5 million: 12%

First-time buyers receive special relief, where they do not pay SDLT on the first £425,000 of the purchase price, provided the property is valued up to £625,000.

| Property Price Band | Standard Rate | First-Time Buyer Rate |

|---|---|---|

| Up to £250,000 | 0% | 0% |

| £250,001 - £425,000 | 5% | 0% |

| £425,001 - £925,000 | 5% | 5% |

| £925,001 - £1.5 million | 10% | 10% |

| Over £1.5 million | 12% | 12% |

Non-residential properties and mixed-use properties (those that have both residential and non-residential use) are taxed differently. The rates for these types of properties are:

Up to £150,000: 0%

£150,001 – £250,000: 2%

Over £250,000: 5%

On April 1, 2025, changes to SDLT thresholds will come into effect, impacting both residential and first-time buyers. The standard SDLT threshold will decrease from £250,000 to £125,000. This means that any property purchase over £125,000 will be subject to SDLT, leading to higher upfront costs for many buyers.

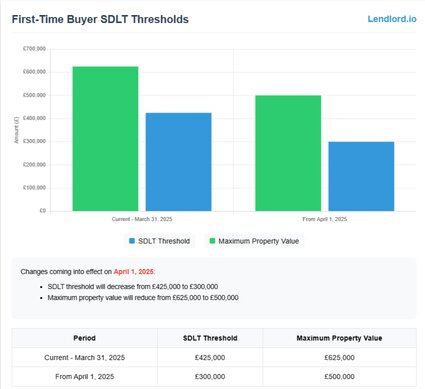

First-time buyers will also see a reduction in their relief threshold, from £425,000 to £300,000 for properties valued up to £500,000. This change aims to balance the housing market, but may also present challenges for first-time buyers facing increased costs.

These changes will likely affect the affordability of properties, especially for first-time buyers and those purchasing in high-demand areas. First-time buyers may need to budget more for SDLT, and existing homeowners may see reduced flexibility in moving to larger properties.

For homebuyers, navigating the new thresholds means planning finances carefully and possibly seeking advice from property tax specialists. The government aims to ensure a fairer distribution of tax burdens, but market analysts have voiced concerns about the impact on the property market’s fluidity.

Calculating SDLT liability is straightforward but requires an understanding of the relevant rates and thresholds. For residential properties, SDLT is calculated on the portion of the property price within each band. For example, if buying a property for £450,000, SDLT is applied as follows:

£250,000 at 0%: £0

£200,000 at 5%: £10,000

Total SDLT payable would be £10,000.

Buyers can use online SDLT calculators provided by websites like GOV.UK or Rightmove to estimate their liability quickly. Special considerations are necessary for additional properties, where an extra surcharge is applied.

If you are purchasing an additional property—such as a second home or buy-to-let investment—a surcharge is applied to the standard SDLT rates. Currently, the surcharge is 3%, but it recently increased to 5% as of October 31, 2024.

This means that an individual buying an additional property for £400,000 will pay an extra 5% SDLT on top of the standard rates. The surcharge is intended to manage housing supply and discourage speculative purchases that could otherwise make housing less affordable for first-time buyers.

Certain exemptions are available for buyers who sell their previous main residence within 36 months, allowing them to reclaim the surcharge. Understanding the nuances of these exemptions can save significant amounts of money for landlords and investors.

Scotland has its own property transaction tax called Land and Buildings Transaction Tax (LBTT), which differs from SDLT in both rates and thresholds. The LBTT applies to residential and non-residential properties, with different bands.

LBTT thresholds are generally more favorable for lower-value properties, benefiting first-time buyers in Scotland. Buyers should refer to Revenue Scotland for up-to-date rates and guidance.

In Wales, the Land Transaction Tax (LTT) replaced SDLT in 2018. LTT is structured similarly but with different rates and thresholds, often resulting in lower tax obligations for lower-value properties. Buyers in Wales can find specific LTT information on the Welsh Revenue Authority website.

The current SDLT threshold for first-time buyers is £425,000 for properties valued up to £625,000. From April 1, 2025, this threshold will be reduced to £300,000 for properties valued up to £500,000.

The changes will result in higher SDLT liabilities for most buyers, particularly those purchasing properties over £125,000. First-time buyers will need to consider their budget more carefully due to the reduced relief threshold.

Yes, certain exemptions are available, including first-time buyer relief, exemptions for properties under £125,000, and refunds for those who sell their main residence within three years of purchasing an additional property.

England and Northern Ireland use SDLT, while Scotland uses LBTT and Wales uses LTT. Each tax has different rates and thresholds, which can affect the cost of buying property in these regions.

If Stamp Duty Land Tax (SDLT) is not paid within 14 days of the completion date of a property purchase, interest charges and possible fines will apply. As of 26 November 2024, the interest rate on late payments is 7.25%.

The late filing penalty increases to £200 for returns filed more than 3 months late.

Early settlement of SDLT will help you avoid these charges.

Stamp Duty Land Tax (SDLT) is a significant factor in property purchases in England and Northern Ireland, affecting buyers differently based on property value, type, and buyer status. With upcoming changes in April 2025, understanding SDLT rates, thresholds, and exemptions is more crucial than ever.

Buyers should take advantage of online calculators to estimate SDLT liability and seek advice from professionals to ensure compliance and cost-effectiveness. Staying informed about regional variations like LBTT in Scotland and LTT in Wales will also help prospective homeowners plan better.

As the government continues to make adjustments, navigating SDLT will remain a key aspect of property transactions in the UK. Being prepared and understanding these changes will help buyers make informed decisions and minimize tax liabilities.

Sign Up for Free Today & Get 40% Off Lendlord Premium Plan!